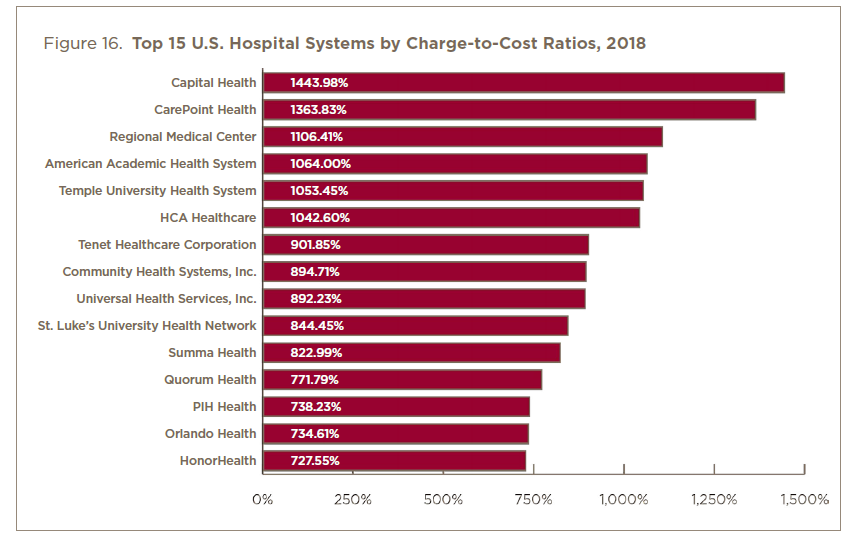

And the worst offenders...

Cost Shifting

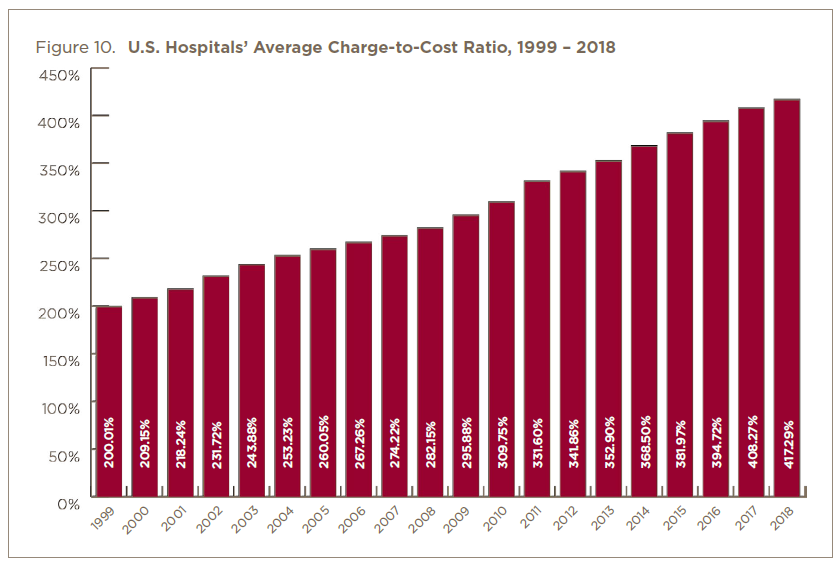

Despite the many advances made in healthcare transparency and improvements in efficiency, cost shifting to Private / Commercial Payers is alive and well. As the most recent report from Nurses United (Nov 2020) illustrates, the Nationwide Average Charge to Cost ratio on Medical Claims is 417% as of 2018 (a 135% increase over the past decade), with the worst offender charging 14xs cost! To visualize what this national average looks like, for every $100 in cost to a Hospital Facility to perform a service (after supplies, payroll, rent, etc.), they charge Private and Commercial (Non-Exchange) Payers $417 (on average). Not a bad margin.....for the hospitals!

What's going on?:

- Leveraged Trend - group health contracts by the dominate BUCA network providers are being used as a bargaining chip to get better terms on government contracts like Medicare Advantage. The Carriers are positioning themselves for an expansion of government run healthcare by offering more attractive health plans options. To keep their medical providers whole, the Carriers are positioning group health employers as "loss leaders" with the network providers (not great contracts for employers - awesome contracts for the MA programs). Look at the annual financial reports by the big Carriers and see what their priorities for growth are? Look at the group health renewals offered by the large Carriers.....note their trends of 8-12%. This is triple the MA contracts.

- Market Consolidation - the federal government has failed miserably in preventing near monopolies from occurring in the health insurance industry. Look at Dialysis service providers - two major players (Fresenius and DaVita) control an estimated 92% of the Market. Fresenius is also a maker of Dialysis supplies, and they control 33% of that market as well. Its gotten so bad, even the America's Health Insurance Plans (AHIP) came out with an article on August 26th, 2021 that talks about how Hospital Consolidations Hurts Americans. It drives prices higher, and increases the commoditization of the sick. It further puts the administrators and venture capital firms in charge of a patient's health, not their physician.

As such, we have and continue to aggressively support Value Based Network models, such as RBP programs, Direct Contracts and Skinny Network options (with a rental network). It's the only tools we have that levels the playing field for employers, and offers them a real chance of having plan that will trend at, or below, Wage Growth.