Group Health captives

A Group Health Captive allows members to share a layer of risk with other group members. If the group runs well, money is returned to the group members that participated in the surplus. If it runs poorly, their paid in premium and potentially their collateral is used to pay claims.

Here’s what our Captive Programs offers an insurance consultant:

- Same underwriting process as traditional stop-loss programs (it’s easy to get started)

- Aggressive pricing – underwriting is based on Reference Based Reimbursement Models

- Lower year-over-year trend (plan cost trends much closer to Medicare than the commercial PPO market)

- Better plan performance = stickier clients, more referrals

- The opportunity for the consultant to share risk with his client (thus becoming a true partner of the client, not just a vendor)

Let’s better illustrate how a Traditional Stop Loss Program compares to a Captive model.

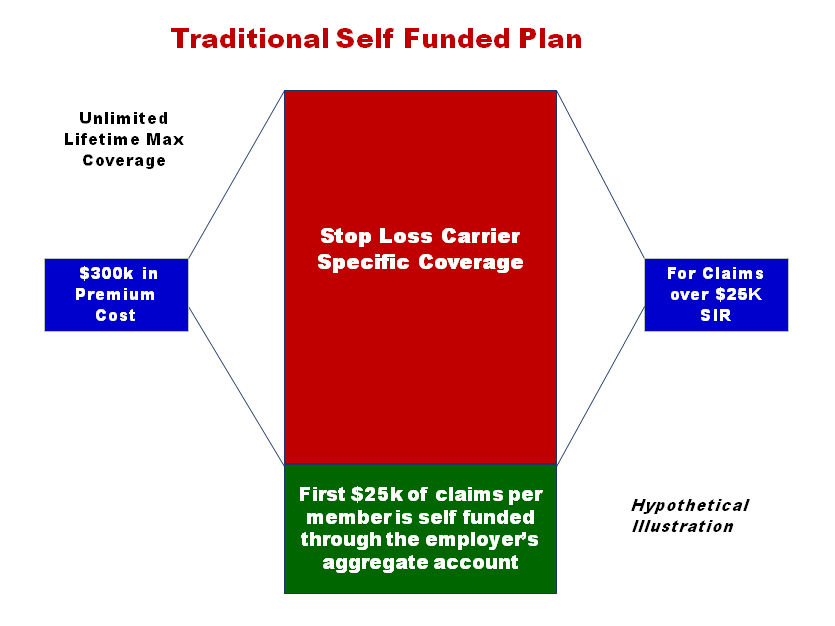

Traditional Self Funded Plan

In this example, the employer has a $25K Specific Individual Retention (SIR) point, meaning all claims underneath this amount will be funded by the Employer’s Aggregate (the self funded component). Anything above this amount will be the covered by the stop-loss carrier. Total premium is $300k with “no” potential for any savings on this amount – all savings potential would be restricted to the aggregate.

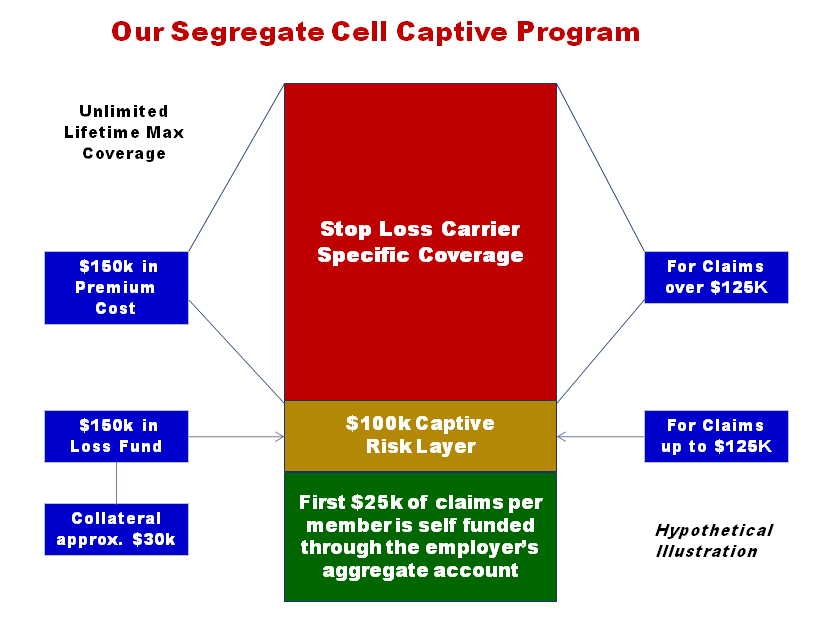

Our Segregated Cell Captive Program

In this model, the employer has the same savings potential as the Traditional Model. However in this program, the $100K “floating” captive risk layer offers an additional opportunity for savings. If the employer has no or few claims that exceed his SIR, and the other employer groups sharing this layer of risk have a favorable year as well, then all the employers would get a prorata share of the surplus premium once the treaty year is closed out. This distribution would received favorable tax treatment as a “qualified” dividend.

Who is a good candidate for a Group Captive model?

Captives are an advanced form of self-funding and offer the potential for additional savings beyond a traditional stop loss program, in addition to some secondary tax benefits. However it also exposes the members to additional financial risk if a worst case scenario hits (loss of collateral). For qualified employer groups, its a great model, but captive have many more uses.

Captives can also be a great fit for:

- Insurance Consultants desiring to establish establish their own risk program

- Associations desiring to create an Association Health Program

- Hospitals desiring to create and share risk in a Community Health Plan

Call Tactical Reinsurance today and let’s discuss your options…